Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273543

Marti Technologies, Inc.

85,226,425 Ordinary Shares

This prospectus relates to the offer and sale by the selling securityholders or their permitted transferees (collectively, the “Selling Securityholders”) of up to 85,226,425 Class A ordinary shares, par value $0.0001 per share (“Ordinary Shares”), of Marti Technologies, Inc., an exempted company incorporated with limited liability under the laws of the Cayman Islands (the “Company”), consisting of (i) 23,802,333 Ordinary Shares issued to certain of the Selling Securityholders named in this prospectus (excluding Former Sponsor (as defined below)) in connection with the Business Combination (as defined below), (ii) 3,578,750 Ordinary Shares held by certain affiliates of Galata Acquisition Sponsor, LLC, a Delaware limited liability company (“Former Sponsor”) and certain previous directors of the Company that were previously held as Class B ordinary shares of the Company (“Founder Shares”), which were converted on a one-for-one basis into Ordinary Shares of the Company (“Founder Converted Shares”) immediately prior to the effective time of the Merger (as defined below), (iii) 15,000 Founder Converted Shares held by Gala Investments LLC (“Gala Investments”), a Delaware limited liability company, and (iv) 57,830,342 Ordinary Shares issuable upon the conversion of (x) $62,920,063 principal amount of convertible notes (the “Convertible Notes”) and (y) up to $32,500,000 in subscriptions of Convertible Notes at the option of Callaway Capital Management LLC (“Callaway Capital Management”) up until July 9, 2026. The number of Ordinary Shares registered for resale by each Selling Securityholder is based on holdings information known to the Company as of April 15, 2024.

We are registering the offer and sale of the securities held by the Selling Securityholders, in some cases, to satisfy certain registration rights we have granted, and in other cases, to provide for resale by affiliates of the Company under the Securities Act. Subject to existing lockup or other restrictions on transfer, the Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of Ordinary Shares offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act.”

We are registering these securities for resale by the Selling Securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest (that receive any of the shares as a gift, distribution, or other non-sale related transfer). We will not receive any proceeds from the sale of the securities by the Selling Securityholders.

This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

Our Ordinary Shares are listed on the NYSE American Stock Exchange (“NYSE American”) under the trading symbol “MRT”. On May 14, 2024, the last reported sale price of our Ordinary Shares was $1.68 per share.

The Selling Securityholders named herein are comprised of Former Sponsor, certain affiliates of Former Sponsor, certain previous independent directors of Galata (as defined herein), certain legacy investors in Marti (as defined herein), the Pre-Fund Subscribers (as defined herein), Callaway Capital Management, Gala Investments,

certain of our executive officers, former executive officers and their affiliates. The following table provides the number of Ordinary Shares offered hereby by each Selling Securityholder as well as the historical weighted-average price paid per Ordinary Share by each Selling Securityholder:

|

Selling Securityholder |

Number of Ordinary Shares Offered for Resale |

Historical Weighted-Average |

||||

|

Agah Ugur |

175,240 |

|

1.07 |

|

||

|

Autotech Fund II, L.P |

353,535 |

(2) |

2.63 |

|

||

|

Esra Unluaslan Durgun |

7,477,950 |

|

— |

|

||

|

European Bank for Reconstruction and Development |

707,069 |

(2) |

2.59 |

|

||

|

Oguz Alper Oktem |

7,477,950 |

|

— |

|

||

|

Seher Sena Öktem |

793,265 |

|

— |

|

||

|

Sumed Equity Ltd. |

8,629,368 |

(2) |

1.51 |

|

||

|

New Holland Tactical Alpha Fund LP |

254,035 |

|

0.01 |

|

||

|

Shelley Guiley |

35,000 |

|

— |

(5) |

||

|

Adam Metz |

35,000 |

|

— |

(5) |

||

|

Tim Shannon |

35,000 |

|

— |

(5) |

||

|

Gala Investments, LLC |

15,000 |

|

0.01 |

|

||

|

405 MSTV I LP |

10,896,308 |

(3) |

1.65 |

|

||

|

Keystone Group, L.P. |

6,294,035 |

(3) |

1.65 |

|

||

|

Gramercy Emerging Markets Dynamic Credit Fund |

629,404 |

(3) |

1.65 |

|

||

|

Gramercy Multi-Asset Fund LP |

944,106 |

(3) |

1.65 |

|

||

|

Funds managed by Weiss Asset Management LP |

7,077,018 |

(3) |

1.81 |

|

||

|

Farragut Square Global Master Fund, LP |

12,531,036 |

(4) |

1.68 |

|

||

|

Callaway Capital Management, LLC |

20,641,076 |

(3) |

1.65 |

|

||

|

Park Loop DC, LLC |

138,186 |

(6) |

0.01 |

|

||

|

Kemal Kaya |

86,844 |

(6) |

0.01 |

|

||

____________

(1) For the purposes of this table, where historical consideration was originally conveyed in Turkish lira, amounts have been converted to U.S. dollars using prevailing exchange rates at the time the transaction occurred.

(2) Represents the sum of previously owned shares and the share amount calculated based on the principal amount of Pre-Fund Notes, all accrued amount of PIK interest under the Pre-Fund Notes at the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(3) Represents the sum of the total cost of Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration, the principal amount of Convertible Notes at the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(4) Represents the sum of the total cost of Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration, the principal amount of Pre-Fund Notes, all of the accrued amount of PIK interest under the Pre-Fund Notes as of the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(5) Reflects Ordinary Shares acquired as stock-based compensation for service on the board of directors of Galata (as defined herein) for no monetary consideration.

(6) Represents the sum of the total cost of Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration.

For information about the price paid by the Selling Securityholders, including prices paid by legacy Marti investors and certain of our executive officers, former executive officers and their affiliates to acquire our Ordinary Shares, please see “Selling Securityholders” and “Risk Factors — Risks Related to Ownership of Securities — Certain existing shareholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in our Company may not experience a similar rate of return.”

The Selling Securityholders can resell, under this prospectus, and upon the conversion of all Convertible Notes, including such notes pursuant to the Callaway Subscription Agreement (as defined herein), up to 85,226,425 Ordinary Shares constituting approximately 148.6% of our issued Ordinary Shares (based on 57,355,324 Ordinary

Shares outstanding as of April 15, 2024). Sales of a substantial number of Ordinary Shares in the public market by the Selling Securityholders and/or by our other existing securityholders, or the perception that those sales might occur, could depress the market price of our Ordinary Shares and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price of our Ordinary Shares.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” and a “foreign private issuer” as defined under the Securities and Exchange Commission, or SEC, rules and will be subject to reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus and other risk factors contained in the documents incorporated by reference herein for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated May 30, 2024

|

Page |

||

|

ii |

||

|

iii |

||

|

iv |

||

|

vi |

||

|

vii |

||

|

viii |

||

|

ix |

||

|

1 |

||

|

6 |

||

|

7 |

||

|

58 |

||

|

59 |

||

|

60 |

||

|

61 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

72 |

|

|

91 |

||

|

98 |

||

|

104 |

||

|

111 |

||

|

115 |

||

|

117 |

||

|

120 |

||

|

124 |

||

|

126 |

||

|

127 |

||

|

129 |

||

|

132 |

||

|

Enforceability of Civil Liabilities Under U.S. Securities Laws |

133 |

|

|

133 |

||

|

134 |

||

|

134 |

||

|

F-1 |

You should rely only on the information contained in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

This prospectus is part of a registration statement on Form F-1 filed with the SEC. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the Ordinary Shares and other information you should know before investing. Any prospectus supplement or post-effective amendment to the registration statement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement or post-effective amendment to the registration statement, you should rely on the information contained in that particular prospectus supplement or post-effective amendment to the registration statement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find More Information.” You should rely only on information contained in this prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities through agents or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

Unless otherwise stated or the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to Marti Technologies, Inc., an exempted company incorporated with limited liability under the laws of the Cayman Islands, and its subsidiaries. As described under “Prospectus Summary — Recent Developments,” in connection with the Closing (as defined below) on July 10, 2023, we changed our legal name from Galata Acquisition Corp. to Marti Technologies, Inc. All references to “Galata” refer to Galata Acquisition Corp., an exempted company incorporated with limited liability under the laws of the Cayman Islands, prior to the Closing and references to “Marti” refer to Marti Technologies I Inc., a Delaware corporation (formerly known as Marti Technologies Inc.), and its subsidiaries.

ii

In this prospectus, unless otherwise specified or the context otherwise requires:

• “$,” “US$,” “USD” and “U.S. dollar” each refer to the United States dollar; and

• “₺,” “TL” and “lira” each refer to the Turkish lira.

Certain amounts described herein have been expressed in U.S. dollars for convenience, and when expressed in U.S. dollars in the future, such amounts may be different from those set forth herein due to intervening exchange rate fluctuations. The Company and certain of our subsidiaries use USD as their functional currency and certain of Marti’s subsidiaries, including Marti İleri Teknoloji A.Ş., use TL as their functional currency. If the legal records are kept in a currency other than the functional currency, the consolidated financial statements are initially translated into the functional currency and then translated into USD. For the companies in Türkiye that book legal records in TL, currency translation from TL to the presentation currency USD is made under the framework described below:

• Assets and liabilities are translated using the Central Bank of the Republic of Türkiye (“TCMB”) U.S. dollar buying rate prevailing at the balance sheet date:

• December 31, 2023: 1 U.S. dollar = TL 29.4382;

• December 31, 2022: 1 U.S. dollar = TL 18.6983; and

• December 31, 2021: 1 U.S. dollar = TL 13.3290.

• Income and expenses are translated from TL to USD using the TCMB U.S. dollar average buying rates:

• 2023: 1 U.S. dollar = TL 23.7464;

• 2022: 1 U.S. dollar = TL 16.5520; and

• 2021: 1 U.S. dollar = TL 8.8719.

Marti İleri Teknoloji A.Ş. used Turkish Lira (“TL”) as its functional currency until the end of February 2022. Since the cumulative three-year inflation rate rose to above 100% at the end of February 2022, based on the Turkish nation-wide consumer price indices announced by Turkish Statistical Institute (“TSI”), Türkiye is currently considered a hyperinflationary economy under FASB ASC Topic 830, Foreign Currency Matters starting from March 1, 2022. Consequently, Marti İleri Teknoloji A.Ş. has remeasured its financial statements prospectively into new functional currency, USD, which is the non-highly inflationary currency in accordance with ASC 830-10-45-11 and ASC 830-10-45-12. According to ASC 830-10-45-9, ASC 830-10-45-10 and ASC 830-10-45-17, at the application date (March 1, 2022), the opening balances of non-monetary items are remeasured in USD, which has become the new functional currency for Marti İleri Teknoloji A.Ş. Subsequently, non-monetary items are accounted for as if they had always been assets and liabilities in USD. Monetary items are treated in the same manner as any other foreign currency monetary items. Subsequently, monetary items are remeasured into USD using current exchange rates. Differences arising from the remeasurement of monetary items are recognized in profit or loss. See “Presentation of Financial Information” for more information.

iii

In addition to the financial measures prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), our management uses certain non-GAAP measures to assess performance.

Adjusted EBITDA is a non-GAAP measure for reporting used by us and is calculated by adding depreciation, amortization, taxes, financial expenses (net of financial income) and one-time charges and non-cash adjustments, to net income (loss).

Pre-depreciation contribution per ride is a non-GAAP measure for reporting used by us and is calculated by adding depreciation per ride to gross profit per ride. The numerator of this metric is our pre-depreciation contribution, which is calculated as our net revenue less all variable costs, excluding depreciation, necessary to make vehicles available for rent on the field, during a given time period.

Financial measures that are not in accordance with U.S. GAAP should not be considered as alternatives to operating income, cash flows from operating activities or any other performance measures derived in accordance with U.S. GAAP. These measures have important limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because of these limitations, we rely primarily on our U.S. GAAP results and use Adjusted EBITDA and Pre-depreciation contribution per ride only as supplements.

The following table presents a reconciliation of Adjusted EBITDA to net income (loss), which is the most directly comparable GAAP measure, for the periods indicated:

|

Year ended December 31, |

||||||||||||

|

(in thousands except as otherwise noted) |

2023 |

2022 |

2021 |

|||||||||

|

Net Loss |

$ |

(33,815 |

) |

$ |

(14,246 |

) |

$ |

(14,472 |

) |

|||

|

Depreciation and Amortization |

|

10,045 |

|

|

9,097 |

|

|

5,473 |

|

|||

|

Income Tax Expense |

|

— |

|

|

— |

|

|

888 |

|

|||

|

Financial Income |

|

(3,561 |

) |

|

(2,567 |

) |

|

(180 |

) |

|||

|

Financial Expense |

|

6,773 |

|

|

1,932 |

|

|

4,712 |

|

|||

|

Customs tax provision expense |

|

32 |

|

|

78 |

|

|

592 |

|

|||

|

Lawsuit provision expense |

|

846 |

|

|

175 |

|

|

35 |

|

|||

|

Stock based compensation expense accrual |

|

1,989 |

|

|

1,658 |

|

|

852 |

|

|||

|

Founders’ salary adjustment |

|

— |

|

|

— |

|

|

218 |

|

|||

|

Other |

|

— |

|

|

— |

|

|

238 |

|

|||

|

Adjusted EBITDA |

$ |

(17,692 |

) |

$ |

(3,873 |

) |

$ |

(1,645 |

) |

|||

Pre-depreciation contribution per ride is calculated by adding depreciation per ride to gross profit per ride. The numerator of this metric is our pre-depreciation contribution, which is calculated as our net revenue (please see the metric above for the calculation of our net revenue) less all variable costs, excluding depreciation, necessary to make vehicles available for rent on the field, during a given time period. Our variable costs include the field operations team, the field operations service vans and motorcycles, the fuel consumed by field operations service vans and motorcycles, the repair and maintenance team, spare parts, charging station rent, electricity costs, customer service call center costs, field operations control center costs, occupancy fees paid to municipalities, data costs for servers and the internet connectivity of our vehicles, payment processing costs, invoice costs, and other operating costs. Pre-depreciation contribution is divided by the total number of rides completed by our vehicles during a given time period in order to reflect the pre-depreciation contribution per ride. We believe this is an important metric for management as it lets us assess the efficiency of our field operations and repair and maintenance teams in servicing our vehicles on the field, distinct from the performance of our vehicle team in increasing the useful life of our vehicles off of the field as reflected by depreciation. The metric also lets us compute the number of rides after which we pay back the fully loaded cost of our vehicles, by dividing our fully loaded vehicle cost by our pre-depreciation contribution per ride. This makes it an important metric for investors to track our operating efficiency and unit economics.

iv

The following table presents a reconciliation of pre-depreciation contribution per ride to gross profit per ride in our Two-wheeled Electric Vehicle segment, which is the most directly comparable GAAP measure, for the periods indicated:

|

Year ended December 31, |

||||||||||||

|

2023 |

2022 |

2021 |

||||||||||

|

Gross Profit per ride |

$ |

(0.25 |

) |

$ |

(0.07 |

) |

$ |

0.00 |

|

|||

|

Depreciation per ride |

$ |

(0.58 |

) |

$ |

(0.30 |

) |

$ |

(0.29 |

) |

|||

|

Pre-Depreciation Contribution Per Ride |

$ |

0.33 |

|

$ |

0.22 |

|

$ |

0.30 |

|

|||

v

PRESENTATION OF FINANCIAL INFORMATION

This prospectus contains the audited consolidated financial statements of Marti Technologies, Inc. and its subsidiaries as of December 31, 2023 and 2022 and for each of the years in the three-year period ended December 31, 2023.

Unless otherwise indicated, financial data presented in this prospectus has been taken from the audited financial statements of Marti included in this prospectus. Unless otherwise indicated, financial information of Marti has been prepared in accordance with U.S. GAAP.

vi

This prospectus contains estimates, projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors” in this prospectus. Unless otherwise expressly stated, we obtained industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

vii

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our businesses. This prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to create, and does not imply, a relationship with us, or an endorsement or sponsorship by or of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, ™ or ℠ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

viii

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and the information incorporated by reference herein include certain “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, the markets in which we operate, as well as any information concerning possible or assumed future results of our operations.

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments. There can be no assurance that future developments affecting us will be those that we have anticipated. Such forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in forward-looking statements herein.

Many factors could cause actual results or performance to be materially different from those expressed or implied by the forward-looking statements in this prospectus, including without limitation: (i) the effect of the public listing of our securities on our business relationships, performance, financial condition and business generally, (ii) the outcome of any legal proceedings that may be instituted against us or our directors or officers, (iii) our ability to maintain the listing of our securities on the NYSE American, (iv) volatility in the price of our securities due to a variety of factors, including without limitation changes in the competitive and highly regulated industries in which we plan to operate, variations in competitors’ performance and success and changes in laws and regulations affecting our business, (v) our ability to implement business plans, forecasts, and other expectations, and identify opportunities, (vi) the risk of downturns in the highly competitive tech-enabled mobility services industry, (vii) our ability to build our brand and consumers’ recognition, acceptance and adoption of our brand, (viii) the risk that we may not be able to effectively manage our growth, including our design, research, development and maintenance capabilities, (ix) technological changes and risks associated with doing business in an emerging market, (x) risks relating to our dependence on and use of certain intellectual property and technology and (xi) other factors discussed under the section titled “Risk Factors” in this prospectus, which section is incorporated herein by reference.

The foregoing list of risk factors is not exhaustive. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements herein. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. We undertake no obligation, except as required by law, to revise publicly any forward-looking statement to reflect circumstances or events after the date of this prospectus or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we will file from time to time with the Securities and Exchange Commission (the “SEC”) after the date of this prospectus.

ix

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

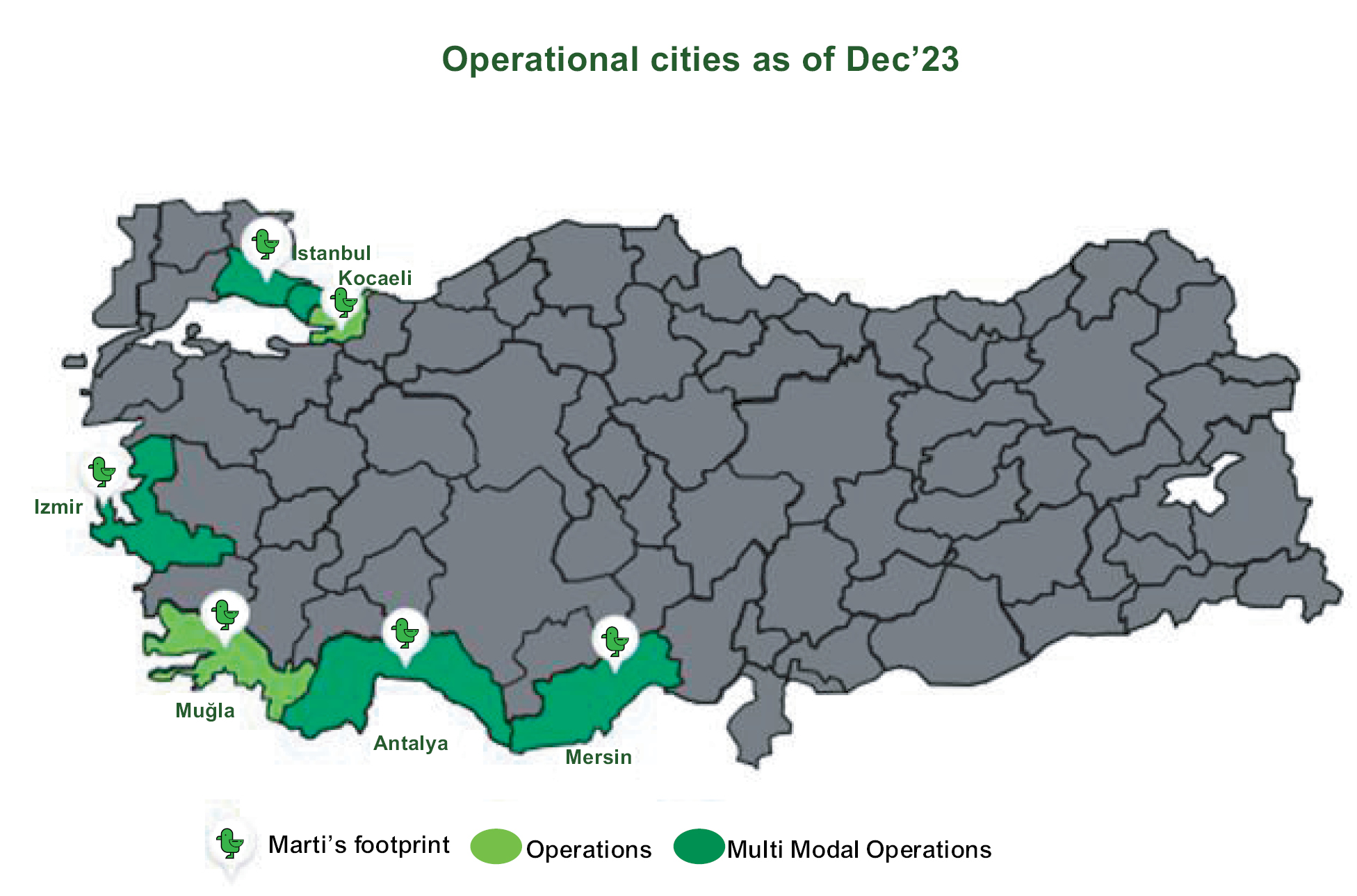

Marti was founded in 2018 to offer tech-enabled urban transportation services to riders across Türkiye. Marti launched two-wheeled electric vehicle operations in March 2019 and now has a fully funded fleet of more than 38,000 e-mopeds, e-bikes and e-scooters, serving 6 cities across Türkiye, serviced by proprietary software systems and IoT infrastructure. In addition, Marti operates a ride-hailing service, offering car and motorcycle ride-hailing options that connect riders with drivers traveling in the same direction. As of December 31, 2023, we have served more than 77 million rides to more than 4.9 million unique riders. We define a unique rider as a paying customer who has completed at least one ride on a Marti e-scooter, e-bike or e-moped, or over our ride-hailing service since we launched our operations in March 2019. We are currently the number one urban mobility app in Türkiye across iOS and Android, as measured by the total number of downloads among all apps in the travel category of both stores which serve within city rather than between city transportation.

We offer environmentally sustainable transportation services to our riders. Our rentable services are currently delivered via fully electric two-wheeled vehicles, and our ride-hailing service promotes shared trips, thereby contributing to environmental sustainability through reduced emissions in the cities where we operate.

In October 2022, Marti launched its car and motorcycle ride-hailing service. Riders and drivers agree on the price of the ride, and we currently do not enable payment over our app or charge a fee for this service. With this addition, we are aligning our services to cater to a broader and more diverse customer base and better meet customer demand for both four- and two-wheeled vehicles. As of December 31, 2023 our ride-hailing service has served over 498,000 unique riders and includes over 106,000 registered drivers, including over 88,000 registered drivers in Istanbul. This is in contrast to 19,845 taxis serving the city of Istanbul.

We plan to continue to grow our existing urban transportation services, introduce additional forms of environmentally sustainable mobility services that are electric and/or shared, and leverage our existing scale and customer base to offer adjacent, tech-enabled services beyond transportation. Our operations have helped us avoid approximately 1,600 tons of CO2 emissions in 2022, equivalent to the CO2 absorbed by approximately 72,000 mature trees. We believe our plan for sustainable growth positions our services to be an integral part of the transportation networks of the cities we serve, and of the lives of our customers.

Corporate Information

We are an exempted company limited by shares incorporated under the laws of the Cayman Islands on February 26, 2021, under the name Galata Acquisition Corp. Upon the closing of the Business Combination (as defined below) on July 10, 2023, we changed our name to Marti Technologies, Inc.

Our registered office is Stuarts Corporate Services Ltd., P.O. Box 2510, Kensington House, 69 Dr Roy’s Drive, George Town, Grand Cayman KY1-1104, and our principal executive office is Buyukdere Cd. No:237, Maslak, 34485, Sariyer/Istanbul, Türkiye. Our website address is www.marti.tech. We do not incorporate the information contained on, or accessible through, our websites into this prospectus, and you should not consider it a part of this prospectus. The SEC maintains a website at www.sec.gov where you may access reports and other information that we file with or furnish electronically to the SEC. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor New York, NY 10168.

1

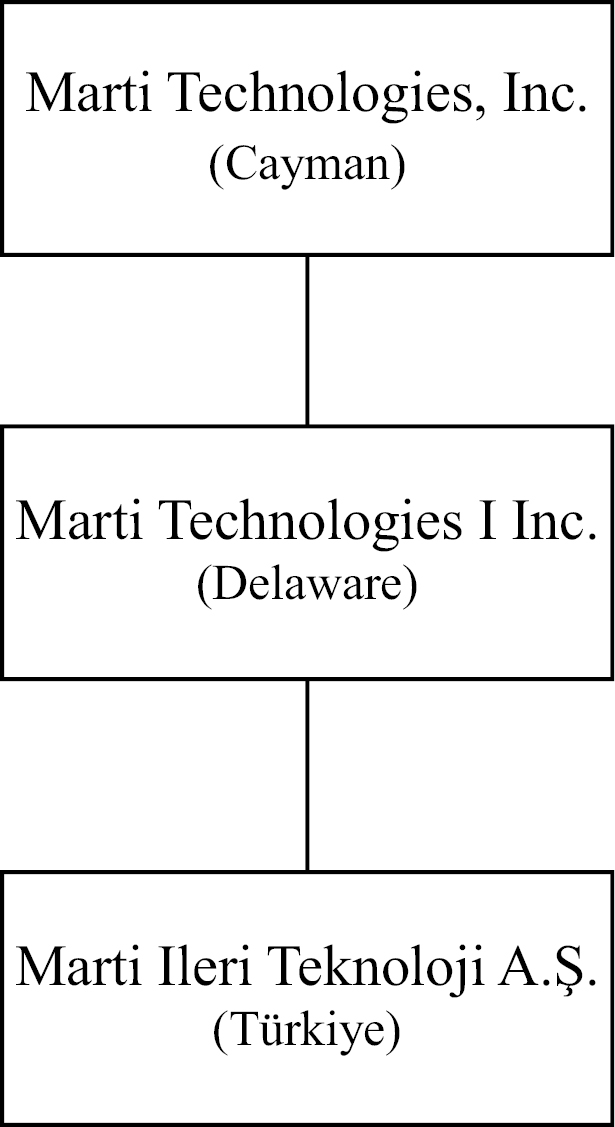

Our Organizational Structure

The following diagram illustrates the structure of the Company as of the date hereof.

Tax Residence

As discussed more fully under “Material U.S. Federal Income Tax Considerations — Treatment as a Domestic Corporation for U.S. Federal Income Tax Purposes,” we believe that, pursuant to Section 7874 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), even though the Company is an exempted company incorporated with limited liability under the laws of the Cayman Islands, the Company will be treated as a U.S. domestic corporation for all purposes of the Code. The Company will therefore be taxed as a U.S. domestic corporation for U.S. federal income tax purposes. As a result, the Company will be subject to U.S. federal income tax on its worldwide income.

In addition, any dividends paid by the Company to a non-U.S. Holder, as defined in the discussion under the heading “Material U.S. Federal Income Tax Considerations — Tax Considerations Applicable to Non-U.S. Holders,” would be subject to U.S. federal income tax withholding at the rate of 30%, or such lower rate as may be provided in an applicable income tax treaty. Each investor should consult its own tax adviser regarding the U.S. federal income tax treatment of the Company and the tax consequences of holding our Ordinary Shares.

Recent Developments

Callaway Subscription Agreement

On May 4, 2023, Galata and Callaway Capital Management LLC (“Callaway”) entered into a convertible note subscription agreement (the “Callaway Subscription Agreement”). Callaway is an affiliate of a director of Galata and the Callaway Subscription Agreement was unanimously approved by the Galata board of directors. Pursuant to the terms of the Callaway Subscription Agreement, Callaway or its designee has the option (the “Option”) (but not the obligation) to subscribe for Convertible Notes in an aggregate principal amount up to $40.0 million during the period beginning on the Closing Date and ending on the one year anniversary of the Closing Date (the “Subscription End Date”). On January 10, 2024, Marti and Callaway entered into an amendment agreement to the Callaway Subscription Agreement (the “Amendment Agreement”), pursuant to which, the Subscription End

2

Date shall be, initially, the date that is fifteen (15) months after the Closing Date and shall be automatically extended by three (3) months for each issuance of $5,000,000 of the aggregate principal amount of the Convertible Notes subscribed by Callaway following the date thereof.

MSTV Subscription Agreement

On March 22, 2024, Marti and an existing investor (“MSTV”) entered into a convertible note subscription agreement (the “Additional Subscription Agreement”). Pursuant to the terms of the Additional Subscription Agreement, MSTV subscribed for Convertible Notes in an aggregate principal amount of $7,500,000 (the “MSTV Subscription”). The MSTV Subscription shall be deemed as a partial exercise of Callaway’s Option.

Callaway Commitment Letter

On March 22, 2024, Callaway provided a commitment letter to the Company (the “Commitment Letter”) in order to evidence its commitment to (i) subscribe for convertible notes in an aggregate principal amount of $15,000,000, with the relevant closing date occurring on or before the one-year anniversary of March 22, 2024 and (ii) timely deliver the relevant purchase price as described in the Callaway Subscription Agreement.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved (to the extent applicable to a foreign private issuer). If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company under the JOBS Act until the earliest of (a) the last day of our first fiscal year following the fifth anniversary of our initial public offering, (b) the last date of our fiscal year in which we have total annual gross revenue of at least $1.235 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC with at least $700.0 million of outstanding securities held by non-affiliates or (d) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the previous three years. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

We report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including, but not limited to:

• the rules under the Exchange Act requiring domestic filers to issue financial statements prepared in accordance with U.S. GAAP;

• the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

• the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events.

3

We intend to take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as (i) more than 50% of our outstanding voting securities are held by U.S. residents and (ii) any of the following three circumstances applies: (A) the majority of our executive officers or directors are U.S. citizens or residents, (B) more than 50% of our assets are located in the United States or (C) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are not emerging growth companies and will continue to be permitted to follow our home country practice on such matters.

Summary of Risk Factors

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, but are not limited to, the following:

• Sales of a substantial number of our securities in the public market by the selling securityholders could cause the price of our Ordinary Shares to fall.

• Certain existing shareholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive investment return based on the current trading price, and may realize significant profits. Future investors in our Company may not experience a similar investment return.

• We have a relatively short operating history and a new and evolving business model, which makes it difficult to evaluate our future prospects, forecast financial results and assess the risks and challenges we may face.

• We have incurred significant operating losses in the past and may not be able to achieve or maintain profitability in the future.

• Our ability to continue as a going concern depends on our ability to continue obtaining sufficient funding to finance our operations due to our history of recurring losses and anticipated expenditures.

• If we fail to retain existing riders or add new riders, or if our riders decrease their level of engagement with our products and services, our business, financial condition, and results of operations may be significantly harmed.

• Our only significant asset is ownership of Marti Delaware and its affiliates and such ownership may not be sufficient to pay dividends or make distributions or obtain loans to enable us to pay any dividends on our Class A ordinary shares (the “Ordinary Shares”) or satisfy other financial obligations.

• We operate in a new and rapidly changing industry, which makes it difficult to evaluate our business and prospects.

• The market for micromobility vehicle sharing is in an early stage of growth, and if such market does not continue to grow, grows more slowly than we expect or fails to grow as large as we expect, our business, financial condition, and results of operations could be adversely affected.

• We launched a ride-hailing service, which may be difficult to monetize and may subject us to increased liability.

• Our future operating results depend upon our ability to obtain vehicles that meet our quality specifications in sufficient quantities on commercially reasonable terms.

• The markets in which we operate are highly competitive, and competition represents an ongoing threat to the growth and success of our business.

• If we are unable to attract or retain a sufficient number of driver and riders, whether due to market competition or other factors, our platform will become less appealing to users, which could adversely affect the value of our business and could have a material adverse effect on our business, results of operations, and prospects.

4

• If platform users engage in, or are exposed to, criminal, violent, dangerous, or inappropriate activity resulting in significant safety incidents, it may undermine our ability to attract and retain both drivers and riders, which could adversely impact our reputation and have a material adverse effect on our business, results of operations, and prospects.

• We have announced our sustainability targets which may require substantial effort, resources, and management time to achieve. However, unforeseen circumstances, some beyond our control, could necessitate adjustments to our planned timelines for fulfilling these commitments.

• Our user growth and engagement on mobile devices depend upon effective operation with mobile operating systems, networks, and standards that we do not control.

• Our business could be adversely impacted by changes in the Internet and mobile device accessibility of users and unfavorable changes in or our failure to comply with existing or future laws governing the Internet and mobile devices.

• We may be party to intellectual property rights claims and other litigation that are expensive to support, and if resolved adversely, could have a significant impact on us and our shareholders.

• Action by governmental authorities to restrict access to our products and services in their localities could substantially harm our business and financial results.

• Our business is subject to a wide range of laws and regulations, many of which are evolving, and failure to comply with such laws and regulations could adversely affect our business, financial condition, and results of operations.

• Our business currently requires us to source parts, materials, and supplies internationally, and supply chain disruptions, foreign currency exchange rate fluctuations and changes to international trade agreements, tariffs, import and excise duties, taxes or other governmental rules and regulations could adversely affect our business, financial condition, results of operations, and prospects.

• Because we are incorporated under the laws of the Cayman Islands, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited.

• Our principal executive offices and other operations and facilities are located in Türkiye and, therefore, our prospects, business, financial condition, and results of operations may be adversely affected by political or economic instability in Türkiye.

• We are exposed to fluctuations in currency exchange rates.

• We qualify as an “emerging growth company” and a smaller reporting company, and the reduced disclosure requirements applicable to “emerging growth companies” and smaller growth companies may make our securities less attractive to investors.

• The requirements of being a public company may strain our resources, divert our management’s attention and affect our ability to attract and retain qualified board members.

• If we fail to put in place appropriate and effective internal control over financial reporting and disclosure controls and procedures, we may suffer harm to our reputation and investor confidence levels.

• As an exempted company limited by shares incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the NYSE American corporate governance listing standards applicable to domestic U.S. companies; these practices may afford less protection to shareholders than they would enjoy if we complied fully with the NYSE American corporate governance listing standards.

• An active, liquid trading market for our securities may not be sustained.

• If securities or industry analysts do not publish enough number of research or publish inaccurate or unfavorable research about our business, the price and trading volume of our securities could decline.

5

The summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains a more detailed description of our Ordinary Shares.

|

Securities being registered for resale by the Selling Securityholders named in the prospectus |

Up to 85,226,425 Ordinary Shares. |

|

|

Offering prices |

The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” |

|

|

Ordinary shares issued and outstanding |

57,355,324 Ordinary Shares as of April 15, 2024. |

|

|

Use of proceeds |

All of the Ordinary Shares offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective amounts. We will not receive any of the proceeds from these sales. |

|

|

Lock-up restrictions |

Certain of our shareholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Securities Eligible for Future Sales — Lock-Up.” |

|

|

Dividend policy |

We have never declared or paid any cash dividends. Our board of directors (“Board”) will consider whether or not to institute a dividend policy. We presently intend to retain our earnings for use in business operations and, accordingly, it is not anticipated that our Board will declare dividends in the foreseeable future. We have not identified a paying agent. See “Dividend Policy.” |

|

|

Risk factors |

Prospective investors should carefully consider the section titled “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in the securities offered hereby. |

|

|

Market for our ordinary shares |

Our Ordinary Shares are listed on the NYSE American under the symbol “MRT”. |

6

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our ordinary shares could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus. As stated elsewhere in this prospectus, unless otherwise stated or the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to Marti Technologies, Inc., an exempted company incorporated with limited liability under the laws of the Cayman Islands, and its subsidiaries. As described under “Prospectus Summary — Recent Developments,” in connection with the Closing on July 10, 2023, we changed our legal name from Galata Acquisition Corp. to Marti Technologies, Inc. All references to “Galata” refer to Galata Acquisition Corp., an exempted company incorporated with limited liability under the laws of the Cayman Islands, prior to the Closing and references to “Marti” refer to Marti Technologies I Inc., a Delaware corporation (formerly known as Marti Technologies Inc.), and its subsidiaries.

Risks Related to Our Securities

Sales of a substantial number of our securities in the public market by the Selling Securityholders could cause the price of our Ordinary Shares to fall.

The Selling Securityholders can resell, under this prospectus, and upon the conversion of all Convertible Notes, including such notes pursuant to the Callaway Subscription Agreement (as defined herein), up to 85,226,425 Ordinary Shares constituting approximately 148.6% of our issued Ordinary Shares. Sales of a substantial number of Ordinary Shares in the public market by the Selling Securityholders and/or by our other existing securityholders, or the perception that those sales might occur, could depress the market price of our Ordinary Shares and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price of our Ordinary Shares.

Certain existing shareholders purchased securities in the Company at a price below the current trading price of such securities, and may experience a positive investment return based on the current trading price, and may realize significant profits. Future investors in our Company may not experience a similar investment return.

Certain shareholders in the Company, including certain of the Selling Securityholders, acquired Ordinary Shares at prices below the current trading price of our Ordinary Shares, and may experience a positive investment return based on the current trading price.

The 3,473,750 Ordinary Shares included hereby for offer and resale by certain affiliates of Former Sponsor were originally acquired as founder shares of Galata in connection with Galata’s initial public offering, for which Former Sponsor paid an aggregate of approximately $25,000.

7

This prospectus also includes for offer and resale by certain previous independent directors of Galata, certain legacy investors in Marti, the Pre-Fund Subscribers, Callaway Capital Management, Gala Investments certain of our executive officers, former executive officers and affiliates up to 85,226,425 Ordinary Shares. The following table provides the number of Ordinary Shares offered hereby by each Selling Securityholder as well as the (i) historical total amount paid, (ii) the historical weighted-average price paid per Ordinary Share and (iii) the potential profit earned by each Selling Securityholder:

|

Selling Securityholder |

Number of |

Historical |

Historical |

Potential |

||||||

|

Agah Ugur |

175,240 |

|

0.19 |

|

1.07 |

0.11 |

||||

|

Autotech Fund II, L.P |

353,535 |

(3) |

6.72 |

(6) |

2.63 |

— |

||||

|

Esra Unluaslan Durgun |

7,477,950 |

|

0.00 |

(7) |

0.00 |

12.56 |

||||

|

European Bank for Reconstruction and Development |

707,069 |

(3) |

11.44 |

(6) |

2.59 |

— |

||||

|

Oguz Alper Oktem |

7,477,950 |

|

0.00 |

(7) |

0.00 |

12.56 |

||||

|

Seher Sena Öktem |

793,265 |

|

0.00 |

(7) |

0.00 |

1.33 |

||||

|

Sumed Equity Ltd. |

8,629,368 |

(3) |

13.31 |

(6) |

1.51 |

1.47 |

||||

|

New Holland Tactical Alpha Fund LP |

254,035 |

|

— |

(8) |

— |

0.43 |

||||

|

Shelley Guiley |

35,000 |

|

— |

(9) |

— |

0.06 |

||||

|

Adam Metz |

35,000 |

|

— |

(9) |

— |

0.06 |

||||

|

Tim Shannon |

35,000 |

|

— |

(9) |

— |

0.06 |

||||

|

Gala Investments, LLC |

15,000 |

|

0.00 |

(7) |

0.01 |

0.03 |

||||

|

405 MSTV I LP |

10,896,308 |

(4) |

12.80 |

(10) |

1.65 |

0.33 |

||||

|

Keystone Group, L.P. |

6,294,035 |

(4) |

12.80 |

(10) |

1.65 |

0.19 |

||||

|

Gramercy Emerging Markets Dynamic Credit Fund |

629,404 |

(4) |

1.28 |

(10) |

1.65 |

0.02 |

||||

|

Gramercy Multi-Asset Fund LP |

944,106 |

(4) |

1.92 |

(10) |

1.65 |

0.03 |

||||

|

Funds managed by Weiss Asset Management LP |

7,077,018 |

(4) |

12.80 |

(11) |

1.81 |

— |

||||

|

Farragut Square Global Master Fund, LP |

12,531,036 |

(5) |

20.99 |

(12) |

1.68 |

— |

||||

|

Callaway Capital Management, LLC |

20,641,076 |

(4) |

51.2 |

(10) |

1.65 |

0.62 |

||||

|

Park Loop DC, LLC |

138,186 |

|

— |

(8) |

— |

0.23 |

||||

|

Kemal Kaya |

86,844 |

|

— |

(8) |

— |

0.15 |

||||

____________

(1) For the purposes of this table, where historical consideration was originally conveyed in Turkish lira, amounts have been converted to U.S. dollars using prevailing exchange rates at the time the transaction occurred.

(2) Potential profit is calculated assuming the sale of all Ordinary Shares offered by this prospectus by each respective Selling Securityholder and is based on the last reported sale price on May 14, 2024 of our Ordinary Shares on NYSE American of $1.68 per share.

(3) Represents the sum of previously owned shares and the share amount calculated based on the principal amount of Pre-Fund Notes, all accrued amount of PIK interest under the Pre-Fund Notes at the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(4) Calculated based on the principal amount of Convertible Notes at the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(5) Calculated based on the principal amount of Pre-Fund Notes, all of the accrued amount of PIK interest under the Pre-Fund Notes as of the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(6) Represents the sum of the total cost of previously owned shares, the principal amount of Pre-Fund Notes, all of the accrued amount of PIK interest under the Pre-Fund Notes at the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(7) Reflects total dollar amount paid of (a) $42.75 by each of Mr. Oktem and Ms. Durgun, (b) $4.50 by Ms. Oktem and (c) $104.35 by Gala Investments, LLC, which appears as $0.00 million in the above table due to rounding.

(8) Reflects Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration.

8

(9) Reflects Ordinary Shares acquired as stock-based compensation for service on the board of directors of Galata (as defined herein) for no monetary consideration.

(10) Calculated as the sum of principal amounts of Convertible Notes as of the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(11) Represents the sum of the total cost of Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration, the principal amounts of Convertible Notes as of the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

(12) Represents the sum of the total cost of Ordinary Shares acquired from Former Sponsor (as defined herein) for no monetary consideration, the principal amount of Pre-Fund Notes, all of the accrued amount of PIK interest under the Pre-Fund Notes as of the Closing Date and all accrued amount of PIK interest under the Convertible Notes as of April 15, 2024.

Based on the last reported sale price of our Ordinary Shares on May 14, 2024 of $1.68 per share, certain Selling Securityholders named in this prospectus would realize significant profits on the sale of their holdings as compared to the initial consideration paid for such holdings, as detailed above.

Given the relatively lower purchase prices that some of our shareholders paid to acquire Ordinary Shares compared to the current trading price of our Ordinary Shares, these shareholders, some of whom are our Selling Securityholders, in some instances will earn a positive rate of return on their investment, which may be a significant positive rate of return, depending on the market price of our Ordinary Shares at the time that such shareholders choose to sell their Ordinary Shares. Investors who purchase our Ordinary Shares in the open market following the Business Combination may not experience a similar rate of return on the securities they purchase due to differences in the purchase prices and the current trading price. Additionally, even though our Ordinary Shares may be trading at a price below the trading price of Galata’s ordinary shares prior to the Business Combination, certain affiliates of Former Sponsor and other affiliates may still be incentivized to sell their shares due to the relatively lower price they paid to acquire such shares.

Risks Related to Our Business and Industry

We have a relatively short operating history and a new and evolving business model, which makes it difficult to evaluate our future prospects, forecast financial results and assess the risks and challenges we may face.

Our business model is relatively new and rapidly evolving. We were founded in 2018 to offer technology-enabled urban transportation services across Türkiye. We launched operations in 2019 and now have a fully funded fleet of more than 38,000 e-mopeds, e-bikes and e-scooters, serving six cities across Türkiye. We generate revenue mainly from the rides of e-mopeds, e-bikes, and e-scooters completed by our riders. Riders pay an unlock fee to begin a ride and a per minute fee for each minute of the ride. The unlock fee and per minute fee vary by modality, geography, and length of transit. In addition, a small portion of our revenue (less than 1% in 2023, 2022 and 2021) is generated from advance vehicle reservations that enable riders to reserve a vehicle prior to commencing a ride, with a reservation fee charged on a per minute basis. In October 2022, we launched a ride-hailing service offering car, motorcycle, and taxi ride-hailing options that connect riders with drivers traveling in the same direction. Riders and drivers agree on the price of the ride, and we do not currently enable payment over our app or charge a fee for this service.

We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. Risks and challenges we have faced or expect to face as a result of our relatively limited operating history and evolving business model include our ability to:

• make operating decisions and evaluate our future prospects and the risks and challenges we may encounter;

• forecast our revenue and budget for and manage our expenses;

• attract new riders and retain existing riders in a cost-effective manner;

• comply with existing and new or modified laws and regulations applicable to our business;

• manage our software platform and our business assets and expenses;

• plan for and manage capital expenditures for our current and future products and services, and manage our supply chain and manufacturer and supplier relationships related to our current and future products and services;

• develop, manufacture, source, deploy, maintain, and ensure utilization of our assets, including our growing network of vehicles as well as assembly operations;

9

• anticipate and respond to macroeconomic changes and changes in the markets in which we operate;

• maintain and enhance the value of our reputation and brand;

• effectively manage our growth and business operations;

• successfully expand our geographic reach in markets in which we currently operate as well as new markets;

• hire, integrate and retain talented people at all levels of our organization; and

• successfully develop new features, products and services to enhance the experience of customers.

If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition, and results of operations could be adversely affected.

We have incurred significant operating losses in the past and may not be able to achieve or maintain profitability in the future.

We have incurred net losses since our inception, and we may not be able to achieve or maintain profitability in the future. Our expenses will likely increase in the future as we develop and launch new products, services and software platform features, expand in existing and new markets, expand our vehicle fleet, expand marketing channels and operations, hire additional employees, and continue to invest in our products and services and customer engagement. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business sufficient to offset these expenses. For example, we may incur additional costs and expenses related to supply chain disruptions. Furthermore, our products and services require significant capital investments and recurring costs, including debt payments, maintenance, depreciation, asset life, and asset replacement costs, and if we are not able to maintain sufficient levels of utilization of such assets or such products or services are otherwise not successful, our investments may not generate sufficient returns and our financial condition may be adversely affected. Additionally, as a public company, we expect stock-based compensation expense will continue to be a significant expense in future periods.

Given our limited operating history, many of our efforts to generate revenue are new and unproven. For the year ended December 31, 2023, our revenue was $20.0 million, a decrease of 19.8%, as compared to our revenue for the year ended December 31, 2022. For the year ended December 31, 2022, our revenue was $25.0 million, an increase of 47.0%, as compared to our revenue of $17.0 million for the year ended December 31, 2021. Although we have experienced significant revenue growth in most of the recent periods, we cannot guarantee that we will sustain our recent revenue growth rate in future periods as a result of many factors, including decreased demand for our products and services, increased competition and the maturation of our business, and cannot assure you that our revenue will not decline. You should not consider our historical revenue or operating expenses as indicative of our future performance. If our revenue does not increase sufficiently to offset our expenses, if we experience unexpected increases in operating expenses, or if we are required to take charges related to impairments or other matters, we might not achieve or maintain profitability and our business, financial condition, and results of operations could be adversely affected.

If we fail to retain existing riders or add new riders, or if our riders decrease their level of engagement with our products and services, our business, financial condition, and results of operations may be significantly harmed.

The size of our rider base is critical to our success. Our financial performance has been and will continue to be significantly determined by our success in cost-effectively adding, retaining, and engaging active users of our products and services. If people do not perceive our products and services to be useful, reliable, trustworthy, and affordable, we may not be able to attract or retain riders or otherwise maintain or increase the frequency of their use of our products and services. Our rider engagement patterns have varied over time, and rider engagement can be difficult to measure, particularly as we introduce new and different products and services and expand into new markets. Any number of factors could negatively affect rider retention, growth, and engagement, including if:

• riders increasingly engage with other competitive products or services;

• local governments and municipalities restrict our ability to operate our products and services in various jurisdictions at the level at which we desire to operate, or at all;

10

• there are adverse changes to our products, services or business model that are mandated by legislation, regulatory authorities, or litigation;

• we fail to introduce new features, products, or services that riders find engaging;

• we introduce new products or services, or make changes to existing products and services, that are not favorably received;

• riders have difficulty installing, updating, or otherwise accessing our products on mobile devices as a result of actions by us or third parties that we rely on to distribute our products and deliver our services;

• changes in rider preferences or behavior, including decreases in the frequency of use of our products and services;

• there are decreases in rider sentiment about the quality, affordability, or usefulness of our products or concerns related to privacy, safety, security or other factors;

• riders adopt new products and services where our products and services may be displaced in favor of other products or services, or may not be featured or otherwise available;

• technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the rider experience;

• we adopt terms, policies or procedures related to areas such as rider data that are perceived negatively by our riders or the general public;

• we elect to focus our product decisions on longer-term initiatives that do not prioritize near-term rider growth and engagement, or if initiatives designed to attract and retain riders and engagement are unsuccessful or discontinued, whether as a result of actions by us, third parties, or otherwise;

• we fail to provide adequate customer service to riders; or

• we, or other partners and companies in our industry, are the subject of adverse media reports or other negative publicity, even if factually incorrect or based on isolated incidents.

Further, government actions in response to potential future pandemics, such as travel bans, travel restrictions, and shelter-in-place orders, may decrease utilization of our products and services. If we are unable to cost-effectively maintain or increase our rider base and engagement, our products and services may become less attractive to riders and our business, financial condition, and results of operations could be adversely affected.

Changes to our pricing could adversely affect our ability to attract or retain riders.

We regularly analyze data to determine the optimal pricing strategy to support the profitability of our business, while also trying to grow our user base. One of the risks of changing prices is that user demand is sensitive to price increases, particularly given the recent impact inflation has had on consumer spending habits. If we raise prices too much or too often, user demand may decrease. Additionally, factors such as operating costs, legal and regulatory requirements or constraints, and the ability of our competitors to offer more attractive pricing to either their customers or service providers may impact our overall pricing model.

Certain of our competitors offer, or may in the future offer, lower-priced or a broader range of products and services. Similarly, certain competitors may use marketing strategies that enable them to attract or retain riders and service providers at a lower cost than us. In the past, we have made pricing changes and incurred expenses related to marketing and rider payments, and there can be no assurance that we will not be forced, through competition, regulation, or otherwise, to reduce prices for users or increase our marketing and other expenses to attract and retain riders in response to competitive pressures or regulatory requirements. Furthermore, the economic sensitivity of riders on our software platform may vary by geographic location, and as we expand, our pricing methodologies may not enable us to compete effectively in these locations. Local regulations may affect our pricing in certain geographic locations, which could amplify these effects. We have launched, and may in the future launch, new pricing strategies and initiatives, such as subscription packages and rider loyalty programs. We have also modified, and may in the future modify, existing pricing methodologies. Any of the foregoing actions may not ultimately be successful in attracting and retaining riders.

11

As we continue to strive for an optimal pricing strategy, we may launch new pricing initiatives that may not be successful in retaining users. While we do and will attempt to optimize prices and balance supply and demand in our marketplace, including in each of the geographic markets in which we operate, our assessments may not be accurate or there may be errors in the technology used in our pricing and we could be underpricing or overpricing our products and services. In addition, if the products and services on our platform change, then we may need to revise our pricing methodologies. As we continue to launch new and develop existing asset-intensive products and services, factors such as maintenance, debt service, depreciation, asset life, battery swaps, supply chain efficiency, and asset replacement may affect our pricing methodologies. Any such changes to our pricing methodologies or our ability to efficiently price our products and services could adversely affect our business, financial condition, and results of operations.

Our only significant asset is ownership of Marti Delaware and its affiliates and such ownership may not be sufficient to pay dividends or make distributions or obtain loans to enable us to pay any dividends on our Ordinary Shares or satisfy other financial obligations.

We are a holding company and will not directly own any operating assets other than our ownership of interests in Marti Delaware. We depend on Marti Delaware for distributions, loans, and other payments to generate the funds necessary to meet our financial obligations, including our expenses as a publicly traded company and to pay any dividends. The earnings from, or other available assets of, Marti Delaware may not be sufficient to make distributions or pay dividends, pay expenses or satisfy our other financial obligations.

We rely on third parties maintaining open marketplaces to distribute our application and provide the software we use in certain of our products and services. If such third parties interfere with the distribution of our products or services or with our use of such software, if we are unable to maintain a good relationship with such third parties, or if marketplaces are unavailable for any prolonged period of time, our business will suffer.